The 5-Minute Rule for Mileagewise - Reconstructing Mileage Logs

Mileagewise - Reconstructing Mileage Logs - Truths

Table of ContentsExamine This Report on Mileagewise - Reconstructing Mileage Logs4 Easy Facts About Mileagewise - Reconstructing Mileage Logs ExplainedAll About Mileagewise - Reconstructing Mileage LogsAll about Mileagewise - Reconstructing Mileage LogsGetting My Mileagewise - Reconstructing Mileage Logs To WorkAll about Mileagewise - Reconstructing Mileage LogsThe Greatest Guide To Mileagewise - Reconstructing Mileage Logs

Timeero's Fastest Range function recommends the fastest driving course to your workers' destination. This attribute boosts efficiency and adds to set you back financial savings, making it a necessary possession for companies with a mobile labor force. Timeero's Suggested Route function additionally increases accountability and effectiveness. Employees can compare the recommended route with the actual path taken.Such a strategy to reporting and conformity streamlines the commonly intricate job of taking care of gas mileage expenditures. There are many benefits related to making use of Timeero to track mileage. Let's have a look at a few of the application's most remarkable functions. With a trusted mileage tracking tool, like Timeero there is no need to fret about unintentionally omitting a day or piece of info on timesheets when tax time comes.

The Best Strategy To Use For Mileagewise - Reconstructing Mileage Logs

These extra verification actions will keep the IRS from having a reason to object your mileage documents. With accurate gas mileage tracking innovation, your staff members do not have to make harsh gas mileage price quotes or also stress concerning gas mileage expenditure tracking.

If a staff member drove 20,000 miles and 10,000 miles are business-related, you can compose off 50% of all car expenses (best mileage tracker app). You will need to continue tracking mileage for work also if you're making use of the real expense technique. Maintaining gas mileage documents is the only means to separate business and individual miles and give the proof to the IRS

Many gas mileage trackers allow you log your trips by hand while calculating the range and repayment quantities for you. Lots of likewise included real-time journey monitoring - you need to start the app at the start of your journey and stop it when you reach your last location. These applications log your begin and end addresses, and time stamps, in addition to the overall distance and compensation quantity.

Excitement About Mileagewise - Reconstructing Mileage Logs

This includes expenses such as gas, upkeep, insurance coverage, and the lorry's devaluation. For these expenses to be thought about insurance deductible, the car should be utilized for company purposes.

Everything about Mileagewise - Reconstructing Mileage Logs

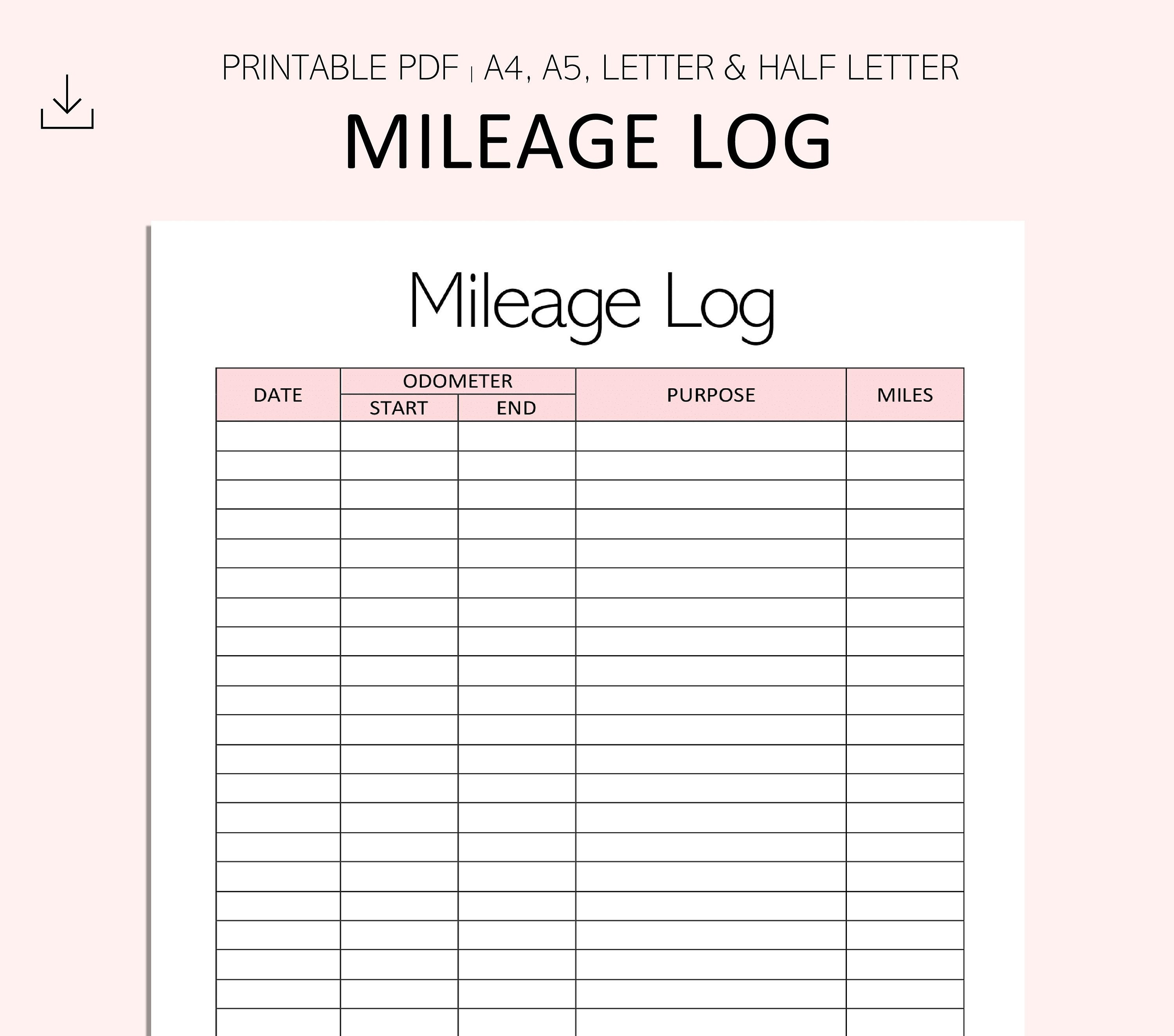

Beginning by videotaping your auto's odometer reading on January 1st and after that once more at the end of the year. In between, carefully track all your service journeys noting down the beginning and finishing analyses. For every journey, record the area and company purpose. This can be simplified by maintaining a driving log in your car.

This includes the complete organization mileage and complete gas mileage accumulation for the year (business + individual), journey's day, destination, and function. It's important to videotape activities immediately and preserve a coexisting driving log describing date, miles driven, and service purpose. Below's exactly how you can improve record-keeping for audit functions: Beginning with guaranteeing a meticulous gas mileage YOURURL.com log for all business-related traveling.

9 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

The real expenditures approach is an alternate to the standard mileage price method. Instead of computing your reduction based upon a fixed price per mile, the real costs technique permits you to subtract the actual prices associated with utilizing your lorry for service functions - best free mileage tracker app. These expenses include gas, upkeep, repair work, insurance coverage, depreciation, and various other associated expenses

Nevertheless, those with substantial vehicle-related expenses or unique problems may profit from the actual costs approach. Please note electing S-corp condition can change this computation. Inevitably, your chosen approach must straighten with your specific monetary goals and tax obligation circumstance. The Criterion Gas Mileage Price is a measure released yearly by the IRS to figure out the deductible costs of operating an automobile for business.

Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

(https://www.edocr.com/v/0ajywrpv/tessfagan90/mileagewise-reconstructing-mileage-logs)Determine your overall company miles by using your beginning and end odometer analyses, and your videotaped service miles. Precisely tracking your exact gas mileage for organization trips help in validating your tax obligation reduction, especially if you choose for the Criterion Gas mileage approach.

Maintaining track of your mileage by hand can call for persistance, yet bear in mind, it might save you money on your taxes. Tape the complete gas mileage driven.

Our Mileagewise - Reconstructing Mileage Logs Statements

And now nearly everyone uses GPS to obtain about. That means almost everybody can be tracked as they go about their business.